CHAPTER 14

UNDERWRITING

Chapter Introduction

A life insurance agent’s work does not stop once a proposal is secured from a prospective customer. The proposal must also be accepted by the insurance company and result in a policy.

Every life insurance proposal indeed has to pass through a gateway where the life insurer decides whether to accept the proposal and if so, on what terms. In this chapter we shall know more about the process of underwriting and the elements involved in the process.

Learning Outcomes

A. Underwriting – Basic concepts

B. Non-medical underwriting

C. Medical underwriting

A. Underwriting – Basic concepts

1. Underwriting purpose

We begin with examining the purpose of underwriting. There are two purposes

i. To prevent anti-selection or selection against the insurer

ii. To classify risks and ensure equity among risks

Definition

The term selection of risks refers to the process of evaluating each proposal for life insurance in terms of the degree of risk it represents and then deciding whether or not to grant insurance and on what terms.

Anti-selection is the tendency of people, who suspect or know that their chance of experiencing a loss is high, to seek out insurance eagerly and to gain in the process.

Example

If life insurers were to be not selective about whom they offered insurance, there is a chance that people with serious ailments like heart problems or cancer, who did not expect to live long, would seek to buy insurance.

In other words, if an insurer did not exercise selection it would be selected against and suffer losses in the process.

2. Equity among risks

Let us now consider equity among risks. The term “Equity” means that applicants who are exposed to similar degrees of risk must be placed in the same premium class. We have already seen how life insurers use a mortality table to determine the premiums to be charged. The table represents the mortality experience of standard lives or average risks. They include the vast majority of individuals who propose to take life insurance.

a) Risk classification

To usher equity, the underwriter engages in a process known as risk classification i.e. individual lives are categorised and assigned to different risk classes depending on the degree of risks they pose. There are four such risk classes.

Diagram 1: Risk classification

i. Standard lives

These consist of those whose anticipated mortality corresponds to the standard lives represented by the mortality table.

ii. Preferred risks

These are the ones whose anticipated mortality is significantly lower than standard lives and hence could be charged a lower premium.

iii. Substandard lives

These are the ones whose anticipated mortality is higher than the average or standard lives, but are still considered to be insurable. They may be accepted for insurance with higher (or extra) premiums or subjected to certain restrictions.

iv. Declined lives

These are the ones whose impairments and anticipated extra mortality are so great that they could not be provided insurance coverage at an affordable cost. Sometimes an individual’s proposal may also be temporarily declined if he or she has been exposed to a recent medical event, like an operation.

3. Selection process

Underwriting or the selection process may be said to take place at two levels:

• At field level

• At underwriting department level

Diagram 2: Underwriting or the selection process

a) Field or Primary level

Field level underwriting may also be known as primary underwriting. It includes information gathering by an agent or company representative to decide whether an applicant is suitable for granting insurance coverage. The agent plays a critical role as primary underwriter. He is in the best position to know the life to be insured.

Many insurance companies may require that agents complete a statement or a confidential report, asking for specific information, opinion and recommendations to be provided by the agent with respect to the proposed life.

A similar kind of report, which has been called as Moral Hazard report, may also be sought from an official of the life insurance company. These reports typically cover the occupation, income and financial standing and reputation of the proposed life.

Fraud monitoring and role of agent as primary underwriter

Much of the decision with regard to selection of a risk depends on the facts that have been disclosed by the proposer in the proposal form. It may be difficult for an underwriter who is sitting in the underwriting department to know whether these facts are untrue and have been fraudulently misrepresented with deliberate intent to deceive.

The agent plays a significant role here. He or she is in the best position to ascertain that the facts that have been represented are true, since the agent has direct and personal contact with the proposed life and can thus monitor if any wilful non - disclosure or misrepresentation has been made with an intent to mislead.

b) Underwriting department level

The second level of underwriting is at the department or office level. It involves specialists and persons who are proficient in such work and who consider all the relevant data on the case to decide whether to accept a proposal for life insurance and on what terms.

4. Methods of underwriting

Diagram 3: Methods of Underwriting

Underwriters may use two types of methods for the purpose:

Judgment Method |

Numerical Method |

Under this method subjective judgment is used, especially when deciding on a case that is complex. |

Under this method underwriters assign positive rating points for all negative or adverse factors (negative points for any positive or favourable factors). |

Example: Deciding whether to give insurance to someone who has acute diabetes and on what terms |

|

In such situations, the department may get the expert opinion of a medical doctor who is also called a medical referee. |

The total number of points so assigned will decide how much Extra Mortality Rating (also called EMR) it has been given. Higher the EMR, more substandard the life is. If the EMR is very high, insurance may even be declined. |

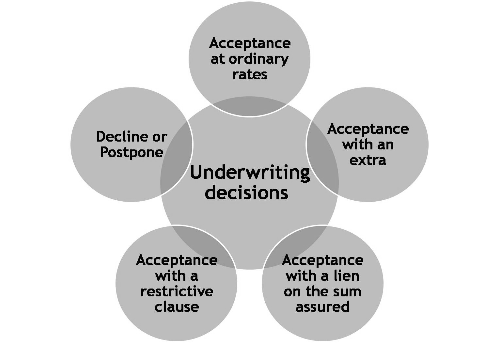

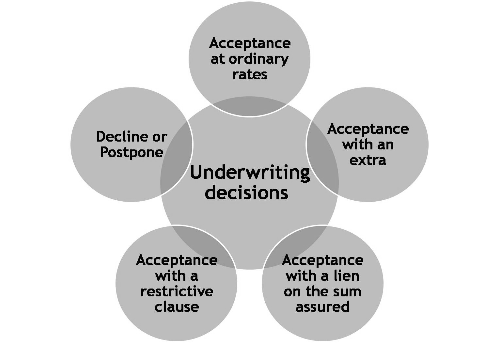

5. Underwriting decisions

Diagram 4: Underwriting decisions

Let us now consider the various kinds of decisions that underwriters may take with regard to a life proposed for underwriting

a) Acceptance at ordinary rates (OR) is the most common decision. This rating indicates that the risk is accepted at the same rate of premium as would apply to an ordinary or standard life.

b) Acceptance with an extra: This is the most common way of dealing with the large majority of sub-standard risks. It involves charging an extra over the tabular rate of premium.

c) Acceptance with a lien on the sum assured: A lien is a kind of hold which the life insurance company can exercise (in part or whole) on the amount of benefit it has to pay in the event of a claim.

Example: It may be imposed in case the life proposed for insurance has suffered and recovered from certain disease like TB. Lien implies that if the life assured dies from a specified cause (for example relapse of the TB) within a given period, only a decreased amount of death benefit may be payable.

d) Acceptance with a restrictive clause: For certain kinds of hazards a restrictive clause may be applied which limits death benefit in the event of death under certain circumstances.

Example is a pregnancy clause imposed on pregnant ladies that limits insurance payable in the event of pregnancy related deaths occurring within say three months of delivery.

e) Decline or postpone: Finally, a life insurance underwriter may decide to decline or reject a proposal for insurance. This would happen when there are certain health /other features which are so adverse that they considerably magnify the incidence of the risk.

Example: An individual who suffers from cancer and has little chance of remission, would be a candidate for rejection,

Similarly in some cases it may be prudent to postpone acceptance of the risk until such time as the situation has improved and become more favourable.

Example

A lady who has just had a hysterectomy operation may be asked to wait for a few months before insurance on her life is allowed, to allow any post operation complications that may have arisen to disappear.

Test Yourself 1

Which of the following cases is likely to be declined or postponed by a life insurer?

I. Healthy 18 year old

II. An obese person

III. A person suffering from AIDS

IV. Housewife with no income of her own

B. Non-medical underwriting

1. Non-medical underwriting

A large number of life insurance proposals may typically get selected for insurance without conducting a medical examination to check the insurability of a life to be insured. Such cases are termed as non-medical proposals.

The case for non-medical underwriting lies in the finding that medical examinations bring out adverse features only in a small proportion (say one tenth) of the cases. The rest can be found out from the answers given in the proposal or the proposed life’s leave records and other documents.

Conducting a medical examination by a qualified doctor would require that fees be paid to the doctor. The cost that can be saved by not conducting such examination is found to be much more than the loss that the life insurer may suffer on account of extra death claims arising as a result of bypassing a medical test. Life insurers have hence adopted the practice of granting insurance without insisting on a medical examination.

2. Conditions for non-medical underwriting

However non-medical underwriting calls for certain conditions to be followed.

i. Firstly only certain categories of females, like working women, may be eligible.

ii. Upper limits on sum insured may be imposed. For example, any case having a sum assured beyond five lakhs may need to be subjected to a medical examination.

iii. Age at entry limits may be imposed – for example, anyone above 40 or 45 years of age has to compulsorily get a medical examination done.

iv. Restriction being imposed with regard to certain plans of insurance – term insurance for example may not be allowed under non-medical category.

v. Maximum term of insurance may be limited to twenty years /up to age 60.

vi. Class of lives: Non-medical insurance may also be allowed to certain specific categories of individuals, for instance, non-medical special is provided to employees of reputed firms – having one year service. These companies have proper leave records and may also have periodic medical examinations so that the employee’s medical status can be easily verified.

3. Rating factors in underwriting

Rating factors refer to various aspects related to financial situation, life style, habits, family history, personal history of health and other personal circumstances in the prospective insured’s life that may pose a hazard and increase the risk. Underwriting involves identifying these hazards and their likely impact and classifying the risk accordingly.

Let us understand how the characteristics of an individual life have an impact on the risk. Broadly these may be divided into two – those which contribute to moral hazard and those which contribute to physical [medical] hazards. Life insurance companies often divide their underwriting into categories accordingly. Factors like income, occupation, lifestyle and habits, which contribute to moral

hazard, are assessed as part of financial underwriting, while medical aspects of health are appraised as part of medical underwriting.

a) Female insurance

Women generally have greater longevity than men. However they may face some problems with respect to moral hazard. This is because many women in Indian society are still vulnerable to male domination and social exploitation. Evils like dowry deaths are prevalent even today. Another factor which can affect longevity of women can arise from problems connected with pregnancy.

Insurability of women is governed by need for insurance and capacity to pay premiums. Insurance companies may thus decide to grant full insurance only to those who have earned income of their own and may impose limits on other categories of women. Similarly some conditions may be levied on pregnant women.

b) Minors

Minors have no contracting power of their own. Hence a proposal on the life of a minor has to be submitted by another person who is related to the minor in the capacity of a parent or legal guardian. It would also be necessary to ascertain the need for insurance, since minors usually have no earned income of their own.

Three conditions would generally be sought when considering insurance for minors:

i. Whether they have a properly developed physique

Poor growth of physique can arise as a result of malnutrition or other health problems posing grave risks.

ii. Proper family history and personal history

If there are adverse indicators here, it may pose risks.

iii. Whether the family is adequately insured

Insurance of minors is generally pursued by families having a culture of insurance. One would thus need to be alert when receiving a proposal on

a child’s life where the parents have not been insured. The underwriter would need to ascertain why such insurance has not been taken. Amount of insurance is also linked to that of parents.

c) Large sums assured

An underwriter needs to be wary when the amount of insurance is very large relative to annual income of the proposed insured. Generally sum assured may be assumed to be around ten to twelve times one’s annual income. If the ratio is much higher than this, it raises the possibility of selection against the insurer.

Example

If an individual has an annual income of Rs. 5 lakhs and proposes for a life insurance cover of Rs. 3 crores, it raises a cause for concern.

Typically concerns can arise in such instances because of the possibility that such a large amount of insurance is being proposed in anticipation of suicide or as a result of expected deterioration in health. A third reason for such large sums could be excessive mis-selling by the sales person.

Large sums assured would also imply proportionately large premiums and raise the question whether the payment of such premiums would be continued. In general it would be thus prudent to limit the amount of insurance so that the premium payable is a maximum of say one third of an individual’s annual income.

d) Age

As we have seen elsewhere in this course, the mortality risk is closely related to age. The underwriter needs to be careful when considering insurance for people who are of advanced ages.

Example

If the insurance is being proposed for the first time after age 50, there is a need to suspect moral hazard and enquire about why such insurance was not taken earlier.

We must also note that chances of occurrence of degenerative diseases like diseases of the heart and kidney failure increase with age and become high at older ages.

Life insurers may also seek for some special reports when proposals are submitted for high sums assured / advanced ages or a combination of both.

Example

Examples of such reports are the ECG; the EEG; X-Ray of the chest and Blood Sugar test. These tests may reveal deeper insights about the health of the proposed life than the answers given in the proposal or an ordinary medical examination can provide.

An important part of the underwriting process is admission of age, after verifying the proof of age. There are two types of age proofs

• Standard

• Non-standard

Standard age proofs are normally issued by a public authority. Instances are

• the birth certificate which is issued by a municipality or other government body;

• the school leaving certificate;

• the passport; and

• the employers’ certificate

Where such proofs are not available, the proposer may be asked to bring a non-standard age proof. Examples of the latter are the horoscope; a self- declaration When a standard age proof is not available, non-standard age proof should not be accepted readily. Often, life insurers would impose certain restrictions with respect to plan of insurance, term of assurance; maximum maturity age and maximum sum assured.

e) Moral hazard

Moral hazard may be said to exist when certain circumstances or characteristics of an individual’s financial situation, lifestyle and habits, reputation and mental health indicate that he or she may intentionally engage in actions that increase the risk. There may be a number of factors which may suggest such moral hazard.

Example

When a proposal is submitted at a branch located far away from the place of residence of the proposed insured

A medical examination is done elsewhere even when a qualified medical examiner is available near one’s place of residence.

A third case is when a proposal is made on the life of another without having clear insurable interest, or when the nominee is not the near dependent of the life proposed.

In each such case an enquiry may be made. Finally, when the agent is related to the life assured a moral hazard report may be called from a branch official like the agency manager / development officer.

f) Occupation

Occupational hazards can emanate from any of three sources:

• Accident

• Health hazard

• Moral hazard

Diagram 5: Sources of Occupational Hazards

i. Accidental hazards arise because certain kinds of jobs expose one to the risk of accident. There is any number of jobs in this category – like circus artistes, scaffolding workers, demolition experts and film stunt artistes.

ii. Health hazards arise when the nature of the job is such as to give rise to possibility of medical impairment. There are various kinds of health hazards.

• Some jobs like that of rickshaw pullers involve tremendous physical strain and impact the respiratory system.

• The second situation is where one may be exposed to toxic substances like mining dust or carcinogenic substances (that cause cancer) like chemicals and nuclear radiation.

• A third kind of hazard is posed by high pressure environments like underground tunnels or deep sea, which can cause acute decompression sickness.

• Finally, overexposure to certain job situations (like sitting cramped and glued to a computer in a KPO or working in a high noise setting) can impair functioning of certain body parts in the longer run.

iii. Moral hazard can arise when a job involves proximity or can cause predisposition towards criminal elements or to drugs and alcohol. An example is that of a dancer in a nightclub or an enforcer in a liquor bar or the ‘bodyguard’ of a businessman with suspected criminal links. Again the job profiles of certain individuals like superstar entertainers may lead them to heady intoxicating lifestyles, which sometimes come to tragic ends.

Wherever the occupation falls in one of the categories of jobs listed hazardous, the applicant for insurance would normally be required to complete an occupational questionnaire which would ask for specific details of the job, duties involved and risks exposed to. A rating may also be imposed for occupation in the form of a flat extra (for example Rupees two per thousand sums assured.) Such extra may be reduced or removed when the insured’s occupation changes.

g) Lifestyle and habits

Lifestyle and habits are terms, which cover a wide range of individual characteristics. Generally the agents’ confidential reports and moral hazard reports are expected to mention if any of these characteristics are present in the individual’s lifestyles, which suggest exposure to risk. In particular three features are important:

i. Smoking and tobacco use: It has now been well recognised that use of tobacco is not only a risk in itself but also contributes to increasing other medical risks. Companies charge differential rates today for smokers and non-smokers with the former having to pay much higher premiums. Other forms of tobacco usage like gutkha and paan masala may also attract adverse mortality ratings.

ii. Alcohol: Drinking alcohol in modest quantities and occasionally is not a hazard. It is even an accepted part of social life in many countries. However when it is regularly consumed in excess for a long time it can have a significant impact on mortality risk. Long term heavy drinking can impair liver functioning and affect the digestive system. It can also lead to mental disorders.

Alcoholism is also linked with accidents, violence and family abuse, depression and suicides. Where the proposal form indicates use of alcohol, the underwriter may call for further details and decide on the case depending on the extent of usage and any complications that are indicated to have been caused as a result.

iii. Substance abuse: Substance abuse refers to the use of various kinds of substances like drugs or narcotics, sedatives and other similar stimulants. Some of these are even illegal and their use indicates criminal disposition and moral hazard. Where substance abuse is suspected, the underwriter may need to call for a number of tests to check the abuse. Insurance is often declined in such cases.

Test Yourself 2

Which of the following is an example of moral hazard?

I. Stunt artist dies while performing a stunt

II. A person drinking copious amounts of alcohol because he is inured

III. Insured defaulting on premium payments

IV. Proposer lying on policy document

C. Medical underwriting

1. Medical underwriting

Let us now consider some of the medical factors that would influence an underwriter’s decision. These are generally assessed through medical underwriting. They may often call for a medical examiner’s report. Let us look at some of the factors that are checked.

Diagram 6: Medical Factors that influence an Underwriter’s Decision

a) Family history

The impact of family history on mortality risk has been studied from three angles.

i. Heredity: Certain diseases can be transmitted from one generation to another, say from parents to children.

ii. Average longevity of the family: When the parents have died early on account of certain diseases like heart trouble or cancer, it may be a pointer that the offspring may also not live long.

iii. Family environment: Thirdly, the environment in which the family livescan cause exposure to infection and other risks.

Life insurers have thus to be careful when entertaining cases of individuals with adverse family history. They may call for other reports and may impose an extra mortality rating in such cases.

b) Personal history

Personal history refers to past impairments of various systems of the human body which the life to be insured has suffered from. The proposal form for life insurance typically contains a set of questions which enquire whether the life to be insured has been under treatment for any of these.

Such problems may also be indicated by the medical examiner’s reports or any special reports called for. The major kinds of ailments that are killer diseases include

i. Cardiovascular diseases which affect the heart and blood system – like heart attack, stroke and haemorrhage

ii. Diseases of the respiratory system like Tuberculosis

iii. Excessive production and reproduction of cells which leads to malignant tumours, also known as cancer

iv. Ailments of the renal system, which includes the kidney and other urinary parts, which can lead to kidney failure and death

v. Impairments of the endocrine system, the most well-known of which is Diabetes. It arises from the body’s inability to generate sufficient insulin to metabolise the sugar (or glucose) in the blood stream.

vi. Diseases of the digestive system like gastric ulcers and cirrhosis of the liver

vii. Diseases of the nervous system

c) Personal characteristics

These can also be significant indicators of the tendency to disease.

i. Build

For instance a person’s build consists of his height, weight, chest and girth of the abdomen. For given age and height, there is a standard weight that has been defined and if the weight is too high or low in relation to this standard weight, we can say that the person is overweight or underweight.

Similarly, it is expected that the chest should be expanded at least by four centimetres in a normal person and that the abdominal girth should not be more than one’s expanded chest.

ii. Blood pressure

Another indicator is a person’s blood pressure. There are two measures of this

• Systolic

• Diastolic

A thumb rule for arriving at normal blood pressure readings given age is

For Systolic: It is 115 + 2/5 of age.

For Diastolic: It is 75 + 1/5 of age

Thus if age is 40 years, the normal blood pressure should be Systolic 131:

and Diastolic 83.

When the actual readings are much higher than the above values, we say that the person has high blood pressure or hypertension. When it is too low, it is termed as hypotension. The former can have serious consequences.

The pressure of blood flowing in the system can also be indicated by the pulse rate. Pulse rates can vary from 50 to 90 beats per minute with an average of 72.

iii. Urine – Specific gravity

Finally, a reading of the specific gravity of one’s urine can indicate the balance among various salts in the urinary system. It can indicate any malfunctioning of the system.

Test Yourself 3

Why is heredity history of importance in medical underwriting?

I. Rich parents have healthy kids

II. Certain diseases can be passed on from parents to children

III. Poor parents have malnourished kids

IV. Family environment is a critical factor

Summary

• To usher equity, the underwriter engages in risk classification where individual lives are categorised and assigned to different risk classes depending on the degree of risks they pose.

• Underwriting or the selection process may be said to take place at two levels:

• At field level and

• At underwriting department level

• Judgment method or numerical method of underwriting is widely used for underwriting insurance proposals.

• Underwriting decisions made by underwriters include acceptance of standard risk at standard rates or charging extra for sub-standard risks. Sometimes there is acceptance with lien on sum assured or acceptance is based on restrictive clauses. Where the risk is large the proposal is declined or postponed.

• A large number of life insurance proposals may typically get selected for insurance without conducting a medical examination to check the insurability of an insurant. Such cases are termed as non-medical proposals.

• Some of the rating factors for non-medical underwriting include

• Age

• Large sum assured

• Moral hazard etc.

• Some of the factors considered in medical underwriting include

• Family history,

• Heredity and personal history etc.

Key Terms

1. Underwriting

2. Standard life

3. Non-medical underwriting

4. Rating factor

5. Medical underwriting

6. Anti-selection