In previous chapters we discussed what life insurance involves and its role in providing financial protection. Security is but one of the concerns of individuals who seek to allocate their income and wealth to meet various needs of the present and the future. Life insurance must thus be understood in the wider context of “Personal Financial Planning”. The purpose of this chapter is to introduce the subject of financial planning.

A. Financial planning and the individual life cycle

B. Role of financial planning

C. Financial planning - Types

1. What is financial planning?

Most of us spend a major part of our lives working to make money. Isn’t it time we began to consider that money can be put to work for us? Financial planning is a smart way to achieve this objective. Let us examine some definitions:

i. Financial planning is a process of identifying one’s life’s goals, translating these identified goals into financial goals and managing one’s finances in ways that will help one to achieve those goals.

ii. Financial planning is a process through which one can chart a roadmap to meet expected and unforeseen needs in one’s life. It involves assessing one’s net worth, estimating future financial needs, and working towards meeting those needs through proper management of finances.

iii. Financial planning is taking action to turn one’s goals and desires into reality.

iv. Financial planning takes into account one’s current and future needs, one’s individual risk profile and one’s income to chart out a roadmap to meet these anticipated needs.

Financial planning plays a crucial role in building a life with less worry. Careful planning can help you set your priorities and work steadily to achieve your various goals.

Diagram 1: Types of Goals

i. These goals may be short term: Buying an LCD TV set or a family vacation

ii. They could be medium term: Buying a house or a vacation abroad

iii. The long term goals may include: Education or marriage of one’s child or post retirement provision

2. Individual’s life cycle

It was William Shakespeare who said that the world was a stage. From the day a person is born till the day of his / her death, he / she goes through various stages in life, during which he / she is expected to play a series of roles – as learner, earner, partner, parent, as provider, as empty nester and the final retirement years.

These stages are illustrated in the diagram given below.

Diagram 2: The Economic Life Cycle

Life Stages and Prioroties

• Learner [till say age 20 -25] : a stage when one is preparing to be a productive citizen through enhancing his or her knowledge and skills. Focus is on raising value of one’s human capital. Funds are required for financing one’s education , For instance, meeting the high cost of fees for an MBA in a prestiegus management institution.

• Earner [from 25 onwards]: the stage when one has found employment and perhaps earns enough to meet his or her needs and has some surplus to spare. The individual at this stage may have family responsibilities and may also engage in safvings and investment towards asset creation with a view to meet the needsthat may arise in the immediate future. For instance, a young man in a Multinational job takes a housing loan and invests in a house.

• Partner [on getting marriage at say 28 -30]: this is the stage when one has got married and now has a family of one’s own. This stage brings into immediate focus a host of concerns associated with building a family and the liabilities that come in its wake – like having a house of one’s own, perhaps a car, consumer durables, planning for children’s future etc.• Parent [say 28 to 35] : these are the years when one has become the proud parent of one or more children. These are typcal; years when one has to worry about their health and education - getting them into good schools etc.

• Provider [say age 35 to 55] : this is the age when children have grown into teenagers, and includes their crucial high school years and college. One is highly concerned about the high cost of education that is needed today to make the child technically and professionally qualified to face the challenges of life. For insrtance, consider the amount that needs to be set up to finance a medical course that runs for five years. In many Indian homes, the girls also get married by the time they have turned into adults. Provision for marriage and settlement of the girls is one of the most critical areas of concern for Indian families. Indeed, marriage and education of children is the number one motive for savings among most Indian families today.

• Empty Nester [age 55 to 65] : the term empty nester implies that the offspring have flown away leaving the nest [the household] empty. This is the period when children have married and sometimes have migrated to other places for work, leaving the parents. Hopefully by this stage, one has liquidated one’s liabilities [like housing loan and other mortgages] and has built up a fund for reirement. This is also the period when degenerative ailments like BP and Diabetes begin to manifest and plague one’s life. Health care protection becomes paramount as thus the need for financial independence and security of income.

• Retirement – the twilight years [age 60 and beyond] : this is the age when one has retired from active work and now draws largely on one’s savings to meet the needs of life. Focus here is on addressing living needs till the end of one’s life and that of one’s spouse. The critical concerns are with health issues, uncertainty about income and loneliness. This is also the period when one would seek to enhance quality of life and enjoy many of the things that one had dreamt of but could never achieve – like pursuing a hobby or going on a vacation or a pilgrimage. The issue – whether one could age gracefully or in deprivation would depend a great deal on whether one has made adequate provision for these years.

As we can see above, the economic life cycle has three phases.

Student Phase |

The first phase is the pre-job phase when one is typically a student. This is a preparatory stage for taking up responsibilities as a productive citizen. The priority is developing one’s skillsets and enhancing one’s human capital value. |

Working Phase |

The phase of work begins somewhere between the ages of 18 to 25 or even earlier, and may last for 35 to 40 years. During this period, the individual comes to earn more than he consumes and thus begins to save and invest funds. |

Retirement Phase |

In the process he accumulates wealth and builds assets which would provide funds for various needs in the future including an income in later years, when one has retired and stopped working. |

3. Why does one need to save and purchase various financial assets?

The reason is that each stage in an individual’s life, when he or she performs a particular role, brings with it a number of needs for which funds have to be provided.

When a person gets married and starts a family of his own, he may need to have his own house. As children grow older, funds are needed for their higher education. As an individual goes well past middle age, the concern is for having provision to meet health costs and post retirement savings so that one does not need to depend on one’s children and become a burden. Living with independence and dignity becomes important.

Savings may be considered as a composite of two decisions.

i. Postponement of consumption: an allocation of resources between present and future consumption

ii. Parting with liquidity (or ready purchasing power) in exchange for less liquid assets. For instance, purchase of a life insurance policy implies exchanging money for a contract which is less liquid.

Financial planning includes both kinds of decisions. One needs to plan in order to save for the future and also must invest wisely in assets which are appropriate for meeting the various needs that will arise in future.

To understand the needs and appropriate assets, it would be relevant to look more closely at the stages of one’s life as are illustrated below

Childhood stage |

When one is a student or learner |

Young unmarried stage |

When one has begun to earn a livelihood but is single |

Young married stage |

When one has become a partner or spouse |

Married with young children stage |

When one has become a parent |

Married with older children stage |

When one has become a provider who has to take care of education and other needs of children who are growing older |

Post family/Pre- retirement stage |

When the children may have become independent and left the house, just as birds leaving an empty nest behind |

Retirement stage |

When one passes through the twilight years of one’s life. One could live with dignity if one has saved and made sufficient provisions for the needs that arise at this stage or one may be destitute and dependent on another’s charity if one has not made such provision |

4. Individual needs

If we look at the above life cycle, we would see that three types of needs can arise. These give rise to three types of financial products.

a) Enabling future transactions

The first set of needs arise from funds that are needed to meet a range of anticipated expenditures that are expected to arise at different stages of the life cycle. There are two types of such needs:

i. Specific transaction needs: Linked to specific life events which require a commitment of resources. For instance making a provision for higher education / marriage of dependents; or purchase of a house or consumer durables

ii. General transaction needs: Amounts set aside from current consumption without being earmarked for any specific purposes – these are popularly termed as ‘future provisions’

b) Meeting contingencies

Contingencies are unforeseen life events that may call for a large commitment of funds which are not met from current income and hence needing to be pre-funded. Some of these events, like death and disability or unemployment, lead to a loss of income. Others, like a fire, may result in a loss of wealth. Such needs may be addressed through insurance, if the probability of their occurrence is low but cost impact is high. Alternatively one may need to set aside a large amount of liquid assets as a reserve as provision for such contingencies.

c) Wealth accumulation

All savings and investments indeed lead to creation of some wealth. When we speak of the accumulation motive it refers to an individual’s desire to invest primarily with the motive of taking advantage and reap benefits from favourable market opportunities. In other words savings and investments are primarily driven by a desire to accumulate wealth.

This motive has also been termed as the speculative motive because an individual is willing to take some risks while investing, with a view to earn a higher return. Higher return is desired because it enables to multiply one’s wealth or net worth more rapidly. Wealth is desired because it is linked with independence, enterprise, power and influence.

5. Financial products

Corresponding to the above sets of needs there are three types of products in the financial market:

Transactional products |

Bank deposits and other savings instruments that enable one to have adequate purchasing power (liquidity) at the right time and quantum. |

Contingency products like insurance |

These provide protection against large losses that may be suffered in the event of sudden unforeseen events. |

Wealth accumulation products |

Shares and high yielding bonds or real estate are examples of such products. Here the investment is made with a view to committing money for making more money. |

i. A need to save – For cash requirements

ii. A need to insure – Against uncertainties

iii. A need to invest – For wealth creation

6. Risk profile and investments

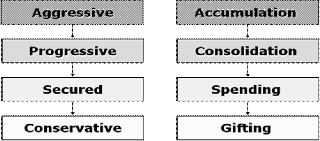

It would also be seen that as an individual moves through various stages in the life cycle, from young earner towards middle ages and then towards the final years of one’s work life, the risk profile, or the approach towards taking risks also undergoes a change.

When one is young, one has a lot of years to look forward to and one may tend to be quite aggressive and willing to take risks in order to accumulate as much wealth as possible. As the years pass however, one may become more prudent and careful about investing, the purpose now being to secure and consolidate one’s investments.

Finally, as one nears retirement years, one may tend to be quite conservative. The focus is now to have a corpus from which one can spend in the post retirement years. One may also think about making bequests for one’s children or gifting to charity etc.

Diagram 3: Risk Profile and Investment Style

Which among the following would you recommend in order to seek protection against unforeseen events?

I. Insurance

II. Transactional products like bank FD’s

III. Shares

IV. Debentures

1. Financial planning

Financial planning is the process in which a client’s current and future needs that may arise are carefully considered and evaluated and his individual risk profile and income are assessed, to chart out a road map for meeting various anticipated / unforeseen needs through recommending appropriate financial products.

Elements of financial planning include:

• Investing - allocating assets based on one’s risk taking appetite,

• Risk management,

• Retirement planning,

• Tax and estate planning, and

• Financing one’s needs

To put it in a nutshell financial planning involves 360 degrees planning.

Diagram 4: Elements of Financial Planning

2. Role of Financial planning

Financial planning is not a new discipline. It was practiced in simple form by our fore fathers. There were limited investment options then. A few decades ago equity investment was considered by a large majority to be akin to gambling. Savings were largely channelled in bank deposits, postal savings schemes and other fixed income instruments. The challenges facing our society and our customers are far different today. Some of them are:

i. Disintegration of the joint family

The joint family has given way to the nuclear family, consisting of father, mother and children. The typical head and earning member of the family has to bear the onus of responsibility for taking care of oneself and one’s immediate family. This calls for a lot of proper planning and one could benefit from a certain amount of support from a professional financial planner.

ii. Multiple investment choices

We have a large number of investment instruments available today for wealth creation, each of these having varying degrees of risk and return. To ensure accomplishment of financial goals, one has to choose wisely and make the right investment decisions based on one’s risk taking appetite. Financial planning can help with one’s asset allocation.

iii. Changing lifestyles

Instant gratification seems to be the order of the day. Individuals want to have the latest mobile phones, cars, large homes, memberships of prestigious clubs, etc. To satisfy these desires they invariably end up with large borrowings. The result is that a large chunk of income goes towards paying off loans, reducing the scope to save. Financial planning is a means to bring awareness and self-discipline as well as to help plan one’s expenditure so that one can cut down unnecessary expenses and succeed in both: maintaining present standard of living while upgrading it over time.

iv. Inflation

Inflation is a rise in the general level of prices of goods and services in an economy over a period of time. This leads to a fall in the value of money. As a result the purchasing power of one’s hard earned money gets eroded. Inflation could play havoc during one’s retirement period, when regular income from one’s gainful occupation has dried out and the only source of income is from past savings. Financial planning can help to ensure that one is equipped to deal with inflation, especially in later years.

v. Other contingencies and needs

Financial planning is also the means to help individuals meet a number of other needs and challenges. For instance, there are unexpected expenses that crop up during medical emergencies or other contingencies that individuals may have to cope with. Similarly, individuals need to manage their tax liabilities prudently. Individuals also need to ensure that their estate consisting of their wealth and properties, smoothly pass on to their loved ones after their death. There are other needs like the need to do charity or meet certain social and religious obligations during one’s lifetime and even thereafter. Financial planning is the means to achieve all this,

3. When is the right time to start financial planning?

Is it meant only for the wealthy? Indeed, planning should ideally start the moment you earn your first salary. There is no trigger as such that says when one should begin to plan.

Hence it is never too early to start. One’s investments would then get the maximum benefit of time. Again, planning is not only for the wealthy individuals. It’s for everyone. To achieve one’s financial goals, one must follow a disciplined approach, beginning with setting financial goals and embarking on dedicated savings in investment vehicles that best suit one’s risk taking appetite. An unplanned, impulsive approach to financial planning is one of the prime causes of financial distress that affects individuals.

When is the best time to start financial planning?

I. Post retirement

II. As soon as one gets his first salary

III. After marriage

IV. Only after one gets rich

Let us now look at the various types of financial planning exercises that an individual may need to do.

Diagram 5: Financial Planning Advisory Services

Consider the various advisory services that may be provided. There are six such areas we shall take up

• Cash planning

• Investment planning

• Insurance planning

• Retirement planning

• Estate planning

• Tax planning

Managing cash flows has two purposes.

i. Firstly one needs to manage income and expenditures flow including establishing and maintaining a reserve of liquid assets to meet unanticipated or emergency needs.

ii. Secondly one needs to systematically create and maintain a surplus of cash for capital investment.

The first step here is to prepare a budget and perform an analysis of current income and expenditure flows. For this, individuals must first prepare a set of reasonable goals and objectives for the future. This would help to determine whether current spending patterns would get them there.

The next step is to analyse the expenses and income flows over last six months to see what regular and lump sum costs have been incurred. Expenses may be categorised into different types and also divided into fixed and variable expenses. While one may not have much control over the fixed expenses, the variable expenses being more discretionary, can often be reduced or postponed.

The third step is to predict future monthly income and expenses over the whole year. On the basis of analysis of past and anticipation for the future, one can design a plan for managing these cash flows.

Another part of the cash planning process is to design strategies for maximizing discretionary income.

One can restructure one’s outstanding debts.

One can meet outstanding credit card debts through consolidating them and paying them off through a bank loan with lower interest.

One may reallocate one’s investments to make them earn more income.

There are certain risks to which individuals are exposed that can keep them from attaining their personal financial goals. Insurance planning involves constructing a plan of action to provide adequate insurance against such risks. The task here is to estimate how much insurance is needed and determining what type of policy is best suited.

i. Life insurance may be decided by estimating the income and expense requirements of the dependents in the event of premature death of the bread winner.

ii. Health insurance requirements may be assessed in terms of the hospitalisation expenses that are likely to be incurred in any family medical emergency.

iii. Finally insurance for one’s assets may be considered in terms of the type and quantum of cover required to protect one’s home/vehicle / factory etc. from the risk of loss.

There is no one right way to invest. What is appropriate would vary from individual to individual. Investment planning is a process of determining the most suitable investment and asset allocation strategies based on an individual’s risk taking appetite, financial goals and the time horizon to meet those goals.

a) Investment parameters

Diagram 6: Investment Parameters

The first step here is to define certain investment parameters. These include:

i. Risk tolerance: A measure of how much risk someone is willing to take in purchasing an investment.

ii. Time horizon: It is the amount of time available to attain a financial objective. The time horizon affects the investment vehicles used to attain the goal. The longer the time horizon, the less concern is there about short term liability. One can then invest in longer term, less liquid assets that earn a higher return.

iii. Liquidity: Individuals whose capacity to invest is limited or whose income and expenditure flows are uncertain or who are investing for meeting a particular personal or business expenditure may be concerned with liquidity or the ability to convert investment into cash without loss of value.

iv. Marketability: The ease with which an asset can be bought or sold.

v. Diversification: The extent to which one seeks to diversify or spread the investments to reduce the risks.

vi. Tax considerations: Many investments confer certain income tax benefits and one may like to consider the post-tax returns of various investments.

b) Selection of appropriate investment vehicles

The next step is selection of appropriate investment vehicles based on the above parameters. The actual selection would depend on the individual’s expectations about return and risk.

In India there are a variety of products that may be considered for the purpose of investments. These include:

• Fixed deposits of banks / corporates,

• Small savings schemes of post office,

• Public issues of shares,

• Debentures or other securities,

• Mutual funds

• Unit linked policies that are issued by life insurance companies etc.

It is the process of determining the amount of money that an individual needs to meet his needs post retirement and deciding on various retirement options for meeting these needs.

Diagram 7: Phases of retirement

Retirement planning involves three phases

a) Accumulation: Accumulation of funds is done through various kinds of strategies to set aside money for investment with this purpose.

b) Conservation: Conservation refers to the efforts made to ensure that one’s investments are put to hard work and that the principal gets maximised during the individual’s working years.

c) Distribution: Distribution refers to the optimal method of converting principal (which we may also call the corpus or a nest egg) into withdrawals / annuity payments for meeting income needs after retirement.

It is a plan for the devolution and transfer of one’s estate after one’s demise. There are various processes like nomination and assignment or preparation of a will. The basic idea is to ensure that one’s property and assets are smoothly distributed and / or utilised according to one’s wishes after one is no more.

Finally tax planning is done to determine how to gain maximum tax benefit from existing tax laws and for planning of income, expenses and investments taking full advantage of the tax breaks. It involves making strategies to reduce, time or shift either current or future income tax liabilities. One must note that the purpose here is to minimise and not evade taxes.

By repositioning one’s investments and seeking out potential tax savings opportunities to take advantage of, it is possible to increase one’s income and savings, which otherwise would have gone to the tax authorities.

Life insurance agents may be often required by their clients and prospective customers to advise them not only about meeting their insurance needs but also for support in meeting their other financial needs as well. A sound knowledge of financial planning and its various types as described above would be of great value to any insurance agent.

Which among the following is not an objective of tax planning?

I. Maximum tax benefit

II. Reduced tax burden as a result of prudent investments

III. Tax evasion

IV. Full advantage of tax breaks

• Financial planning is a process of:

• Identifying one’s life’s goals,

• Translating these identified goals into financial goals and

• Managing one’s finances in ways that will help one to achieve those goals

• Based on the individual life cycle three types of financial products are needed. These help in:

• Enabling future transactions,

• Meeting contingencies and

• Wealth accumulation

• The need for financial planning is further increased by the changing societal dynamics like disintegration of the joint family, multiple investment choices that are available today and changing lifestyles etc.

• The best time to start financial planning is right after one receives the first salary.

• Financial planning advisory services include:

• Cash planning,

• Investment planning,

• Insurance planning,

• Retirement planning,

• Estate planning and

• Tax planning

1. Financial planning

2. Life stages

3. Risk profile

4. Cash planning

5. Investment planning

6. Insurance planning

7. Retirement planning

8. Estate planning

9. Tax planning